When you think about estate planning, a will is the most common thing that springs to the minds of Lampasas County residents. As most people know, a will directs the disposition of your money and possessions after you die. But many people overlook something very important—what happens while you are alive! If you become incapacitated (a legal term meaning that you cannot legally make decisions for yourself), who will take care of you? How can you make sure that the medical treatment you receive will be what you would choose? How will it all get paid for? And will someone you trust even be allowed to cut through the red tape and help you? Luckily, there are two relatively simple but extremely useful documents that will allow your trusted representative to take care of just about everything for you. These documents are called the Durable Power of Attorney and the Medical Power of Attorney. Durable Power of Attorney: A Durable Power of Attorney (Durable POA) is a document which grants rights to the representative of your choice. This document will allow your trusted representative to “step into your shoes” and make legal decisions on your behalf.

Medical Power of Attorney: The Medical Power of Attorney (Medical POA) can be customized as needed, but when you include the HIPAA release and Advance Directive to Physicians language, this one document does three important things.

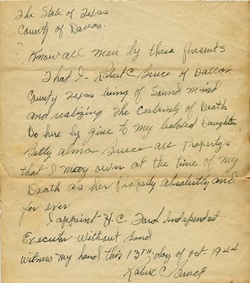

No one knows exactly what the future holds. You might be healthy your entire life, or you might have an accident or suffer an illness which causes you to lose the legal ability to make decisions for yourself. If you do have the unexpected happen, you will need the help of a trusted relative or friend—so make sure that person has the tools they need to help you. Those tools are the Medical and Durable Powers of Attorney. At Martin, Millican, Henderson & Shrum, we have been serving our friends and neighbors in Lampasas, Copperas Cove, Kempner, Lometa, Llano, and Bend since 1975. Our attorneys are helpful, friendly, and experienced at drafting wills and other estate-planning instruments such as Medical and Statutory Durable Powers of Attorney. We will evaluate your unique situation and help you determine exactly which documents and options are right for you. Contact us today to discuss estate planning and related documents like wills and powers of attorney. This blog post only applies to the laws of Texas. The post may or may not match your individual situation. Be careful not to treat it as specific legal advice, as it may not meet your individual needs. It may give you a solid basis for discussion with your own attorney. You should consult with your personal attorney before you take any action on this or any legal issue. Also, please be aware that laws change, so this column is valid only as of the date it was published. This communication does not create an attorney-client relationship between the author and the reader.  When someone dies and they own property in Lampasas County or anywhere else in Texas, that property passes through either “testate” or “intestate” succession. “Testate succession” means that the person who passed away (the decedent) had a will. “Intestate succession” is when the decedent did not have a will. When this happens, property has to be divided up among specified relatives according to the proportions defined by Texas state law. The divisions can be OK for people with extremely simple familial relationship, for example people who have only married one person, purchased all property during marriage, did not inherit any property from others, and had children only from and during the marriage. But for many, many people, the rules made up by Texas lawmakers do not fit the reality of the decedent's situation. We recommend that people have a will made at an attorney’s office—even if the will leaves property in the exact same proportions that intestate succession defines. There are some good reasons for this:

This blog post only applies to the laws of Texas. The post may or may not match your individual situation. Be careful not to treat it as specific legal advice, as it may not meet your individual needs. It may give you a solid basis for discussion with your own attorney. You should consult with your personal attorney before you take any action on this or any legal issue. Also, please be aware that laws change, so this column is valid only as of the date it was published. This communication does not create an attorney-client relationship between the author and the reader.  Many Lampasas County residents have all kinds of animals—domestic cats and dogs, livestock like horses and goats, or even exotic animals of many kinds. When you think about your estate planning, it is easy to take some time to consider how your animals will be cared for after you pass away. The majority of people assume that relatives will be happy to take in Fluffy or Fido. However, animal ownership is a big responsibility and expense. It is not uncommon for people to take the decedent’s pets to an animal shelter or sell livestock to anyone who turns up. Domestic pets taken to animal shelters do not have a guarantee of being adopted, since many shelters euthanize owner surrendered animals because there are too many animals at shelters. Livestock animals also need special consideration and appropriate homes. And very few households are prepared to care appropriately for exotic pets. Luckily, an ounce of prevention is worth a pound of cure. You make sure that your pets and livestock are left to appropriate caregivers in your will, and even create pet trusts to ensure that money is available for their care. With a little advance planning, you can avoid disastrous consequences for your pet. Because animals are currently considered property under Texas law, you can leave them to specific people as a bequest in your will. This is the easiest thing to do, although the success of the method is not assured. You must communicate with the recipient to make sure that he or she is willing and able to care for your pets. You can only leave ownership of your animal to someone using this method; it does not allow you to set rules for what the recipient does with your animal. Once someone has legal title to your animal, he or she is free to sell the animal, give it away, take it to an animal shelter, etc. You should choose a caretaker wisely because your animal will have to depend on his or her good will for care. Pet trusts are a tool that lets you be more specific concerning your animal’s future care. Pet trusts are allowed by Texas state law, specifically the Texas Property Code § 112.037. These allow you to leave enough money to properly care for your animal (whether it is a pet, livestock, or domestic animal) and give special instructions for the animal’s care. For a very in-depth discussion of pet trusts, see Fat Cats & Lucky Dogs by Gerry Beyer. A major benefit of pet trusts is that there is financial incentive for individuals or other groups (such as animal rescues or sanctuaries) to provide care for your animal. Finally, there are some practical steps you can take to help make caring for your animal as easy as possible. Keep a notebook with all important information such as the breeder's or animal rescue's contact information, veterinary records, and a one or two page instruction sheet about how to feed and care for your specific animal (medicine dosage, food type, personality of your animal). This will make things more comfortable for your animal and help it transition to a new home. If you have questions about wills, trusts, estate planning, or pet trusts in Lampasas, Kempner, Lometa, Bend, or Copperas Cove, contact us today at Martin, Millican, Henderson & Shrum for a consultation. We would be happy to help you with estate planning for your animals and the other important things in your life. This blog post only applies to the laws of Texas. The post may or may not match your individual situation. Be careful not to treat it as specific legal advice, as it may not meet your individual needs. It may give you a solid basis for discussion with your own attorney. You should consult with your personal attorney before you take any action on this or any legal issue. Also, please be aware that laws change, so this column is valid only as of the date it was published. This communication does not create an attorney-client relationship between the author and the reader. Who are my Texas Intestate Heirs? What are the Differences Between Heirs and Beneficiaries?4/1/2014

In Texas, probate serves to pass title to the decedent’s heirs and/or beneficiaries. If a person dies without a will, the estate passes “intestate” to his legally defined heirs. Heirs are certain relatives in certain fractions. The identity of a decedent’s heirs varies depending on the decedent’s situation, taking into account what type of property the decedent owned and whether the decedent was married, had children, had children from previous marriages, etc. If a person dies with a will, his estate passes to his beneficiaries. Beneficiaries are the people named in a decedent’s will—these are not necessarily the same people who would be his intestate heirs. You can leave your estate to anyone or almost anything, related or not—but you need a will to do so. Determining the identity of beneficiaries is usually very easy because they are named in the decedent’s will. Your attorney can draft a will that is sufficiently specific to allow easy identification, which is important for clarity and ease of probate after you pass away. Intestate heirs can be more difficult to determine. Intestate heirs are defined by Texas law. Lawmakers chose the intestate distribution based on the theory that people would want their spouse and relatives to inherit their property in certain defined amounts. You can see an Intestate Distribution Chart designed for Texas by clicking this sentence. Finding all the people who are a decedent’s intestate heirs can be easy, but can also be extremely difficult in some cases. When family members are scattered across the state, the nation, or even the world, tracking them down is a significant burden and can be very costly. For this reason, we recommend that people have a will made—even if the will leaves property in the exact same proportions that intestate succession defines. Wills do not expire, so it is never too early to take care of this important document. Come and see us at Martin, Millican, Henderson & Shrum in Lampasas County. We have been serving our friend and neighbors in Lampasas, Copperas Cove, Kempner, Lometa, Llano, and Bend since 1975. A will can save your relatives hundreds or even thousands of dollars, help prevent family disagreements, and make sure that your property is distributed exactly as you desire. Wills are very flexible instruments and can be simple or elaborate—we will help you create a plan that best fits your needs. Contact us today; we will help you make a will that sets your mind at ease. This blog post only applies to the laws of Texas. The post may or may not match your individual situation. Be careful not to treat it as specific legal advice, as it may not meet your individual needs. It may give you a solid basis for discussion with your own attorney. You should consult with your personal attorney before you take any action on this or any legal issue. Also, please be aware that laws change, so this column is valid only as of the date it was published. This communication does not create an attorney-client relationship between the author and the reader.  When a Texas citizen dies owning certain types of real property or personal property, his or her estate will likely need to pass through probate. Land and the structures or items permanently attached to land are called real property; everything else is called personal property. Cash, bank accounts, and life insurance policies are covered under the definition of personal property. Not all of a person’s real and personal property makes it into her “probate estate.” The probate estate is the portion of her possessions which require some kind of probate in order for title or possession to be passed on to her heirs and beneficiaries. Items excluded from the probate estate are mostly those items where title automatically passes to another person at the moment of the decedent’s death. Probate estates in Lampasas County often include some typical kinds of possessions. Community interests in a piece of real estate are part of a probate estate; if a property is owned by a husband and wife together as community property, the deceased spouse’s community interest is part of that spouse’s probate estate. Any real property owned solely by a decedent is part of his estate; this is usually property owned by a single individual, property purchased by an individual before he married, or property he inherited. Bank accounts that are not “joint with right of survivorship” are almost always part of a probate estate. Retirement, life insurance, and other benefits paid directly to an estate are part of a probate estate. Vehicles are frequently included in a probate estate also. Keep in mind that real and personal property's inclusion in probate estates is very fact-specific. There are some common “non-probate assets” that many people own. Bank accounts and mobile homes held “jointly with right of survivorship” pass automatically to the surviving person’s name, and are not part of a probate estate. Real estate can also pass this way using certain kinds of deeds. Life estates, a property interest which expires when a person dies, are not part of a probate estate. Life insurance paid out to a named individual instead of an estate is not part of the probate estate. Property held in trusts typically is not part of a probate estate, although this is dependent on the type of trust. Are you responsible for a loved one’s estate? If you need to probate an estate (or even aren’t sure if you need to), come and see us at Martin, Millican, Henderson & Shrum. We have been serving the people of Lampasas, Copperas Cove, Kempner, Lometa, Llano, and Bend since 1975. We can tell you what kind of probate you may or may not need and help set your mind at ease; simple consultations are free. This blog post only applies to the laws of Texas. The post may or may not match your individual situation. Be careful not to treat it as specific legal advice, as it may not meet your individual needs. It may give you a solid basis for discussion with your own attorney. You should consult with your personal attorney before you take any action on this or any legal issue. Also, please be aware that laws change, so this column is valid only as of the date it was published. This communication does not create an attorney-client relationship between the author and the reader.  If you recently lost a loved one, you may have heard something about “probate of a will as a Muniment of Title.” When can a Lampasas County resident use a Muniment of Title to probate an estate? Probate as a Muniment of Title (“Muniment”) is one of the most basic probate types. A Muniment requires less paperwork, fewer county filing fees, and when it is recorded in a county it serves to “instantly” transfer titles of all of the decedent’s property to his beneficiaries. A Muniment requires that the decedent had a will and also that the estate owes no debts. No executor is appointed with a Muniment, even if the decedent’s will named an executor (logically, an executor’s function is to carry out the terms of a will, but the Muniment does this automatically, which eliminates the need for appointing an executor). Because there is no executor, there are no “Letters Testamentary.” These are documents which a court grants to the executor of an estate. These documents allow the executor to do anything necessary to administer the estate. If the estate is going to require the use of Letters Testamentary, a Muniment is not the correct probate choice. Even though the Muniment statutorily transfers title to the beneficiaries, in practice the Muniment works best when the person who passed away had an estate made up of only real estate or perhaps real estate and an automobile, and with the real estate and automobile being Texas property. The reason for this is that the Muniment is poorly understood by many businesses with which an executor must deal. Banks and life insurance companies often will not accept a Muniment for the purpose of paying out life insurance policies or transferring bank account, especially if they are businesses with a nationwide presence. These companies as a matter of policy often insist on “Letters Testamentary” to transfer property. So while a Muniment would technically be effective, using one in this type of situation is not practical. In one special case, a Muniment of Title is the only option that beneficiaries of an estate can use. This is when a person dies with a will, but more than four years have passed since her death. Four years is the most common statute of limitations for probating a will in Texas, so if it has been more than four years a beneficiary’s options have narrowed dramatically. Is a Muniment of Title the right method for your loved one’s estate? If it is, our experienced attorneys will be able to tell you. If you need to probate an estate (or even aren’t sure if you need to), come and see us at Martin, Millican, Henderson & Shrum. We have been serving the people of Lampasas, Copperas Cove, Kempner, Lometa, Llano, and Bend since 1975. Contact us for a consultation; we will be able to guide you through the Texas probate process efficiently and in the most cost-effective way for your situation. This blog post only applies to the laws of Texas. The post may or may not match your individual situation. Be careful not to treat it as specific legal advice, as it may not meet your individual needs. It may give you a solid basis for discussion with your own attorney. You should consult with your personal attorney before you take any action on this or any legal issue. Also, please be aware that laws change, so this column is valid only as of the date it was published. This communication does not create an attorney-client relationship between the author and the reader. |

Martin Millican Cooley PLLC

Attorneys in Lampasas, Texas specializing in litigation, civil cases, wills, trusts, estates, probate, real estate, business law, family law, & general practice. Archives

September 2017

Categories |

Proudly powered by Weebly

RSS Feed

RSS Feed