Local attorney Scott Cooley of Martin Millican Cooley, PLLC, was named to the annual list of the best lawyers in Texas for the fourth time. The 2017 Super Lawyers Annual List of Top Attorneys will be published in the October issue of Texas Monthly magazine.

Sometimes, it's necessary for spouses to divorce when one or more spouses reside in Texas but are currently deployed from Fort Hood-- sometimes to other states, sometimes to other countries. When a person is not able to appear in court, there is a special process the court requires to allow a divorce decree to be granted.

If you fail to take the proper steps, the judge will refuse to sign your divorce decree. It is a difficult process to undertake on your own, especially if you are inexperienced with the local District Courts or are in another time zone. If you are a deployed military service member in need of assistance, we can help you with the procedures needed to complete your divorce process. Lampasas County and the surrounding area is a beautiful place covered with sprawling family homesteads, some of them hundreds of acres. And many generous grandparents and parents want to provide a few acres to their children and grandchildren to build a home close to the family. Some families are able to proceed on an informal basis, but there are a few issues that may appear.

A major issue is ownership of the home. If you build a home on someone else's property without a written and signed agreement, that house more or less belongs to the property owner. If there's a disagreement in a few years, the home builder may lose out in a dispute with the land owner. Second, many people don't have the cash to build a home from scratch. You may want to use the land as collateral in order to get a bank loan for a stick built home or mobile home trailer. To do this, you will want to have the portion of the land where the home is to be built or installed transferred to your name. Happily the transfer process is not too difficult in Texas. If the portion of land you want conveyed has NOT been surveyed before, you need to contact a land surveyor to survey the property and create a legal description of the land. If the land does not adjoin a public roadway, make sure an easement is included so you are not landlocked. After the surveyor completes his or her work, our attorneys will create the appropriate deed paperwork, arrange for it to be signed in the correct manner, and record it with the county clerk. This transfers the title to the future home builders and will be sufficient to allow banks and lenders to use the property as collateral and issue a loan. If you have any questions about gifting or selling land to someone, contact us at Martin Millican Cooley PLLC. We are very experienced with real estate transactions and help hundreds of people each year with buying or selling land and homes. When one spouse dies, the surviving spouse frequently does not know that he or she needs to take any steps to probate the late spouse’s Will because both spouse’s names were on property, bank accounts, car titles, and so on.

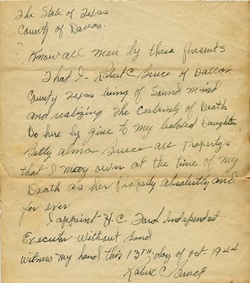

In fact, one of the purposes of probate is to transfer titled assets to the deceased spouse’s beneficiary or beneficiaries—typically this would be the surviving spouse. If the deceased was intestate (which means that he or she did NOT have a will), the property passes to his or her heirs at law. The need for probate often goes unrecognized until the surviving spouse tries to sell titled property like land or vehicles. Sometimes, the surviving spouse passes away and the burden is on the children to complete all the steps required to probate the estates of BOTH parents before the children can go ahead and liquidate the estate assets. The deadline to probate a will in Texas is four years, but there are some options past the four year mark. Call Martin Millican Cooley today for a consultation. We can advise you if there is a necessity for probate, and if so, take the steps required to properly transfer the assets of the estate.  The Texas Estates Code (formerly called the Texas Probate Code) is mainly tailored to the idea of the “nuclear family.” The majority of the statutes are based on the idea that a family is made of one wife married to one husband with children all born into the marriage. Some limited statutes provide for the inheritance of children adopted as minors or children born outside the marriage. But overall, the Code is extremely limited and inflexible. Realistically, it is not uncommon for a person to have had multiple marriages and children from one or more previous marriages. Some families contain non-biological children who were raised in the family but adopted at age 19 or older. Some individuals have children from outside of a marriage. Some have stepchildren or foster children who were raised like their own, but were never formally adopted. Some people never marry and do not children. Some families have devoted--but unmarried--partners. And there are many other even more unique circumstances. The default statutory rules which would apply to your estate as a Lampasas County citizen and Texas resident are almost never exactly what you actually would want to happen. In some cases the law will leave someone you care about very deeply with nothing and no recourse--except for the charity of your relatives. For example, unmarried partners do not stand to inherit under the default rules, whether the relationship lasted for one year or fifty years. Stepchildren who were not formerly adopted will only inherit from their biological parents. Children from previous marriages or outside of a marriage can claim an entire 50% of their deceased parent’s estate; for example, if someone dies with a surviving spouse and eight children with that spouse, but one child from a previous marriage, the one child will receive 50% of the estate, the surviving spouse will receive 50%, and the children from within the marriage will receive 0%. These examples do not even explore the hassles of paternity tests, co-ownership of property by family members, rights of surviving spouses, lawsuits for partition, choosing an administrator for the estate, locating a long-lost relative, inheritance by disabled relatives or minors, and so on. To be sure that you provide appropriately for all of your loved ones, there is nothing like estate planning. In particular, it is very important to have a will or other document that disposes of your estate. Not only does this usually save money for your heirs (both in attorney's fees AND state-mandated costs, a savings of hundreds of dollars or even thousands), it also helps eliminate arguments about family heirlooms, the decedent’s wishes, fairness of division of the estate, and “what daddy/mommy would have wanted.” Estate planning helps ensure that your actual wishes are faithfully carried out and makes sure that you don’t have to rely on the strict rules made up by Texas legislators. Having a will made is a relatively easy procedure and you will have peace of mind knowing that you have clearly expressed your wishes to your family AND the state of Texas. Don’t put off estate planning until it is too late. Contact us at Martin, Millican, Henderson & Shrum for a free consultation. Our experienced attorneys will ask the right quhelp you make sure that your exact wishes are carried out. This blog post only applies to the laws of Texas. The post may or may not match your individual situation. Be careful not to treat it as specific legal advice, as it may not meet your individual needs. It may give you a solid basis for discussion with your own attorney. You should consult with your personal attorney before you take any action on this or any legal issue. Also, please be aware that laws change, so this column is valid only as of the date it was published. This communication does not create an attorney-client relationship between the author and the reader.  When you think about estate planning, a will is the most common thing that springs to the minds of Lampasas County residents. As most people know, a will directs the disposition of your money and possessions after you die. But many people overlook something very important—what happens while you are alive! If you become incapacitated (a legal term meaning that you cannot legally make decisions for yourself), who will take care of you? How can you make sure that the medical treatment you receive will be what you would choose? How will it all get paid for? And will someone you trust even be allowed to cut through the red tape and help you? Luckily, there are two relatively simple but extremely useful documents that will allow your trusted representative to take care of just about everything for you. These documents are called the Durable Power of Attorney and the Medical Power of Attorney. Durable Power of Attorney: A Durable Power of Attorney (Durable POA) is a document which grants rights to the representative of your choice. This document will allow your trusted representative to “step into your shoes” and make legal decisions on your behalf.

Medical Power of Attorney: The Medical Power of Attorney (Medical POA) can be customized as needed, but when you include the HIPAA release and Advance Directive to Physicians language, this one document does three important things.

No one knows exactly what the future holds. You might be healthy your entire life, or you might have an accident or suffer an illness which causes you to lose the legal ability to make decisions for yourself. If you do have the unexpected happen, you will need the help of a trusted relative or friend—so make sure that person has the tools they need to help you. Those tools are the Medical and Durable Powers of Attorney. At Martin, Millican, Henderson & Shrum, we have been serving our friends and neighbors in Lampasas, Copperas Cove, Kempner, Lometa, Llano, and Bend since 1975. Our attorneys are helpful, friendly, and experienced at drafting wills and other estate-planning instruments such as Medical and Statutory Durable Powers of Attorney. We will evaluate your unique situation and help you determine exactly which documents and options are right for you. Contact us today to discuss estate planning and related documents like wills and powers of attorney. This blog post only applies to the laws of Texas. The post may or may not match your individual situation. Be careful not to treat it as specific legal advice, as it may not meet your individual needs. It may give you a solid basis for discussion with your own attorney. You should consult with your personal attorney before you take any action on this or any legal issue. Also, please be aware that laws change, so this column is valid only as of the date it was published. This communication does not create an attorney-client relationship between the author and the reader.  When someone dies and they own property in Lampasas County or anywhere else in Texas, that property passes through either “testate” or “intestate” succession. “Testate succession” means that the person who passed away (the decedent) had a will. “Intestate succession” is when the decedent did not have a will. When this happens, property has to be divided up among specified relatives according to the proportions defined by Texas state law. The divisions can be OK for people with extremely simple familial relationship, for example people who have only married one person, purchased all property during marriage, did not inherit any property from others, and had children only from and during the marriage. But for many, many people, the rules made up by Texas lawmakers do not fit the reality of the decedent's situation. We recommend that people have a will made at an attorney’s office—even if the will leaves property in the exact same proportions that intestate succession defines. There are some good reasons for this:

This blog post only applies to the laws of Texas. The post may or may not match your individual situation. Be careful not to treat it as specific legal advice, as it may not meet your individual needs. It may give you a solid basis for discussion with your own attorney. You should consult with your personal attorney before you take any action on this or any legal issue. Also, please be aware that laws change, so this column is valid only as of the date it was published. This communication does not create an attorney-client relationship between the author and the reader.  Many Lampasas County residents have all kinds of animals—domestic cats and dogs, livestock like horses and goats, or even exotic animals of many kinds. When you think about your estate planning, it is easy to take some time to consider how your animals will be cared for after you pass away. The majority of people assume that relatives will be happy to take in Fluffy or Fido. However, animal ownership is a big responsibility and expense. It is not uncommon for people to take the decedent’s pets to an animal shelter or sell livestock to anyone who turns up. Domestic pets taken to animal shelters do not have a guarantee of being adopted, since many shelters euthanize owner surrendered animals because there are too many animals at shelters. Livestock animals also need special consideration and appropriate homes. And very few households are prepared to care appropriately for exotic pets. Luckily, an ounce of prevention is worth a pound of cure. You make sure that your pets and livestock are left to appropriate caregivers in your will, and even create pet trusts to ensure that money is available for their care. With a little advance planning, you can avoid disastrous consequences for your pet. Because animals are currently considered property under Texas law, you can leave them to specific people as a bequest in your will. This is the easiest thing to do, although the success of the method is not assured. You must communicate with the recipient to make sure that he or she is willing and able to care for your pets. You can only leave ownership of your animal to someone using this method; it does not allow you to set rules for what the recipient does with your animal. Once someone has legal title to your animal, he or she is free to sell the animal, give it away, take it to an animal shelter, etc. You should choose a caretaker wisely because your animal will have to depend on his or her good will for care. Pet trusts are a tool that lets you be more specific concerning your animal’s future care. Pet trusts are allowed by Texas state law, specifically the Texas Property Code § 112.037. These allow you to leave enough money to properly care for your animal (whether it is a pet, livestock, or domestic animal) and give special instructions for the animal’s care. For a very in-depth discussion of pet trusts, see Fat Cats & Lucky Dogs by Gerry Beyer. A major benefit of pet trusts is that there is financial incentive for individuals or other groups (such as animal rescues or sanctuaries) to provide care for your animal. Finally, there are some practical steps you can take to help make caring for your animal as easy as possible. Keep a notebook with all important information such as the breeder's or animal rescue's contact information, veterinary records, and a one or two page instruction sheet about how to feed and care for your specific animal (medicine dosage, food type, personality of your animal). This will make things more comfortable for your animal and help it transition to a new home. If you have questions about wills, trusts, estate planning, or pet trusts in Lampasas, Kempner, Lometa, Bend, or Copperas Cove, contact us today at Martin, Millican, Henderson & Shrum for a consultation. We would be happy to help you with estate planning for your animals and the other important things in your life. This blog post only applies to the laws of Texas. The post may or may not match your individual situation. Be careful not to treat it as specific legal advice, as it may not meet your individual needs. It may give you a solid basis for discussion with your own attorney. You should consult with your personal attorney before you take any action on this or any legal issue. Also, please be aware that laws change, so this column is valid only as of the date it was published. This communication does not create an attorney-client relationship between the author and the reader. Who are my Texas Intestate Heirs? What are the Differences Between Heirs and Beneficiaries?4/1/2014

In Texas, probate serves to pass title to the decedent’s heirs and/or beneficiaries. If a person dies without a will, the estate passes “intestate” to his legally defined heirs. Heirs are certain relatives in certain fractions. The identity of a decedent’s heirs varies depending on the decedent’s situation, taking into account what type of property the decedent owned and whether the decedent was married, had children, had children from previous marriages, etc. If a person dies with a will, his estate passes to his beneficiaries. Beneficiaries are the people named in a decedent’s will—these are not necessarily the same people who would be his intestate heirs. You can leave your estate to anyone or almost anything, related or not—but you need a will to do so. Determining the identity of beneficiaries is usually very easy because they are named in the decedent’s will. Your attorney can draft a will that is sufficiently specific to allow easy identification, which is important for clarity and ease of probate after you pass away. Intestate heirs can be more difficult to determine. Intestate heirs are defined by Texas law. Lawmakers chose the intestate distribution based on the theory that people would want their spouse and relatives to inherit their property in certain defined amounts. You can see an Intestate Distribution Chart designed for Texas by clicking this sentence. Finding all the people who are a decedent’s intestate heirs can be easy, but can also be extremely difficult in some cases. When family members are scattered across the state, the nation, or even the world, tracking them down is a significant burden and can be very costly. For this reason, we recommend that people have a will made—even if the will leaves property in the exact same proportions that intestate succession defines. Wills do not expire, so it is never too early to take care of this important document. Come and see us at Martin, Millican, Henderson & Shrum in Lampasas County. We have been serving our friend and neighbors in Lampasas, Copperas Cove, Kempner, Lometa, Llano, and Bend since 1975. A will can save your relatives hundreds or even thousands of dollars, help prevent family disagreements, and make sure that your property is distributed exactly as you desire. Wills are very flexible instruments and can be simple or elaborate—we will help you create a plan that best fits your needs. Contact us today; we will help you make a will that sets your mind at ease. This blog post only applies to the laws of Texas. The post may or may not match your individual situation. Be careful not to treat it as specific legal advice, as it may not meet your individual needs. It may give you a solid basis for discussion with your own attorney. You should consult with your personal attorney before you take any action on this or any legal issue. Also, please be aware that laws change, so this column is valid only as of the date it was published. This communication does not create an attorney-client relationship between the author and the reader.  When a Texas citizen dies owning certain types of real property or personal property, his or her estate will likely need to pass through probate. Land and the structures or items permanently attached to land are called real property; everything else is called personal property. Cash, bank accounts, and life insurance policies are covered under the definition of personal property. Not all of a person’s real and personal property makes it into her “probate estate.” The probate estate is the portion of her possessions which require some kind of probate in order for title or possession to be passed on to her heirs and beneficiaries. Items excluded from the probate estate are mostly those items where title automatically passes to another person at the moment of the decedent’s death. Probate estates in Lampasas County often include some typical kinds of possessions. Community interests in a piece of real estate are part of a probate estate; if a property is owned by a husband and wife together as community property, the deceased spouse’s community interest is part of that spouse’s probate estate. Any real property owned solely by a decedent is part of his estate; this is usually property owned by a single individual, property purchased by an individual before he married, or property he inherited. Bank accounts that are not “joint with right of survivorship” are almost always part of a probate estate. Retirement, life insurance, and other benefits paid directly to an estate are part of a probate estate. Vehicles are frequently included in a probate estate also. Keep in mind that real and personal property's inclusion in probate estates is very fact-specific. There are some common “non-probate assets” that many people own. Bank accounts and mobile homes held “jointly with right of survivorship” pass automatically to the surviving person’s name, and are not part of a probate estate. Real estate can also pass this way using certain kinds of deeds. Life estates, a property interest which expires when a person dies, are not part of a probate estate. Life insurance paid out to a named individual instead of an estate is not part of the probate estate. Property held in trusts typically is not part of a probate estate, although this is dependent on the type of trust. Are you responsible for a loved one’s estate? If you need to probate an estate (or even aren’t sure if you need to), come and see us at Martin, Millican, Henderson & Shrum. We have been serving the people of Lampasas, Copperas Cove, Kempner, Lometa, Llano, and Bend since 1975. We can tell you what kind of probate you may or may not need and help set your mind at ease; simple consultations are free. This blog post only applies to the laws of Texas. The post may or may not match your individual situation. Be careful not to treat it as specific legal advice, as it may not meet your individual needs. It may give you a solid basis for discussion with your own attorney. You should consult with your personal attorney before you take any action on this or any legal issue. Also, please be aware that laws change, so this column is valid only as of the date it was published. This communication does not create an attorney-client relationship between the author and the reader. |

Martin Millican Cooley PLLC

Attorneys in Lampasas, Texas specializing in litigation, civil cases, wills, trusts, estates, probate, real estate, business law, family law, & general practice. Archives

September 2017

Categories |

Proudly powered by Weebly

RSS Feed

RSS Feed